02 May 2025

Save up to £38,000

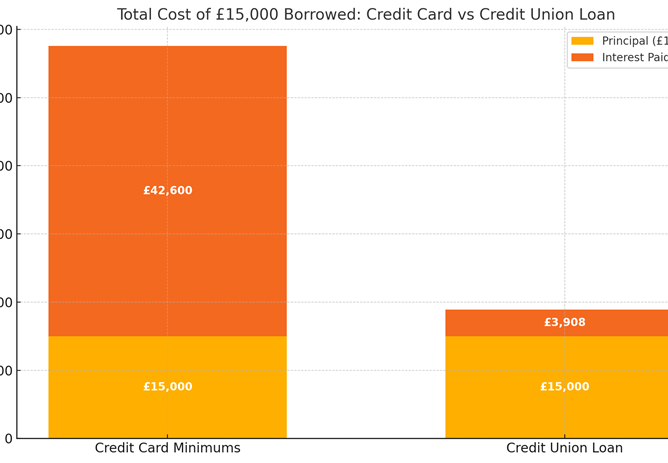

If you're managing a £15,000 credit card balance by making only minimum payments, you could end up paying over £57,000 in total and remain in debt for more than 50 years. In contrast, a credit union loan offers a structured repayment plan with significantly lower interest, helping you save money and become debt-free sooner.

💳 Credit Card Minimum Payments vs. 💰 Credit Union Loan

Credit Card Minimum Payments

Interest Rate: 26.72% APR (average UK rate)

Monthly Payment: Starts around £450 and decreases over time

Total Repaid: Over £57,600

Interest Paid: Nearly £42,600

Repayment Term: Over 50 years

Credit Union Loan

Loan Amount: £15,000

Interest Rate: 9.9% APR

Monthly Payment: Approximately £315.14

Total Repaid: £18,907.74

Interest Paid: £3,907.74

Repayment Term: 5 years

✅ Take Control of Your Finances

Switching to a credit union loan can help you:

Save over £38,000 in interest payments

Become debt-free in a fraction of the time

Gain financial clarity with fixed monthly payments

If you're feeling overwhelmed by credit card debt, consider consolidating with a credit union loan. This approach offers a clear path to financial freedom and peace of mind.

Assumes an average credit card APR of 26.72%, based on UK data (source: Moneyfacts, 2024), with only minimum monthly payments made—starting at 3% and decreasing over time as the balance falls. The total repayment and term are based on typical amortisation for long-term credit card debt without additional borrowing or repayments. The credit union loan example assumes a fixed interest rate of 9.9% APR over 5 years, with equal monthly repayments of approximately £315.14, repaying the full balance with no missed payments or early settlement. These figures are illustrative only and individual circumstances may vary. Always check with your provider for exact terms. This does not constitute financial advice.